The joint venture will focus on commercial real estate, mainly city centre retail and office properties in major cities with good growth prospects primarily outside Helsinki area.

The joint venture will start with a portfolio worth of approximately EUR 160M. The aim is to actively seek further investment opportunities to significantly expand the portfolio size in accordance with the investment strategy.

“Elo is very keen to work together with AP1 and Trevian. Our aim is to create a company that provides commercial premises in the best locations of the cities with solid growth potential. The future investments support also keeping the city centers attractive and lively, which is important for the whole society,” says Antti Muilu, Head of Domestic Real Estate at Elo Mutual Pension Insurance.

The company will have significant resources for further investments and its current commitments enable the total portfolio size to exceed EUR 400M.

“Finland is an interesting market for real estate investments with a positive urban development for larger cities outside the Helsinki area. Första AP-fonden is also pleased to enter a co-operation with both an investor as Elo, who shares AP1’s long-term perspective, and a professional asset manager as Trevian,” says Johan Temse, Investment Manager at AP1.

Trevian will be responsible for the management and the deal sourcing of the joint venture.

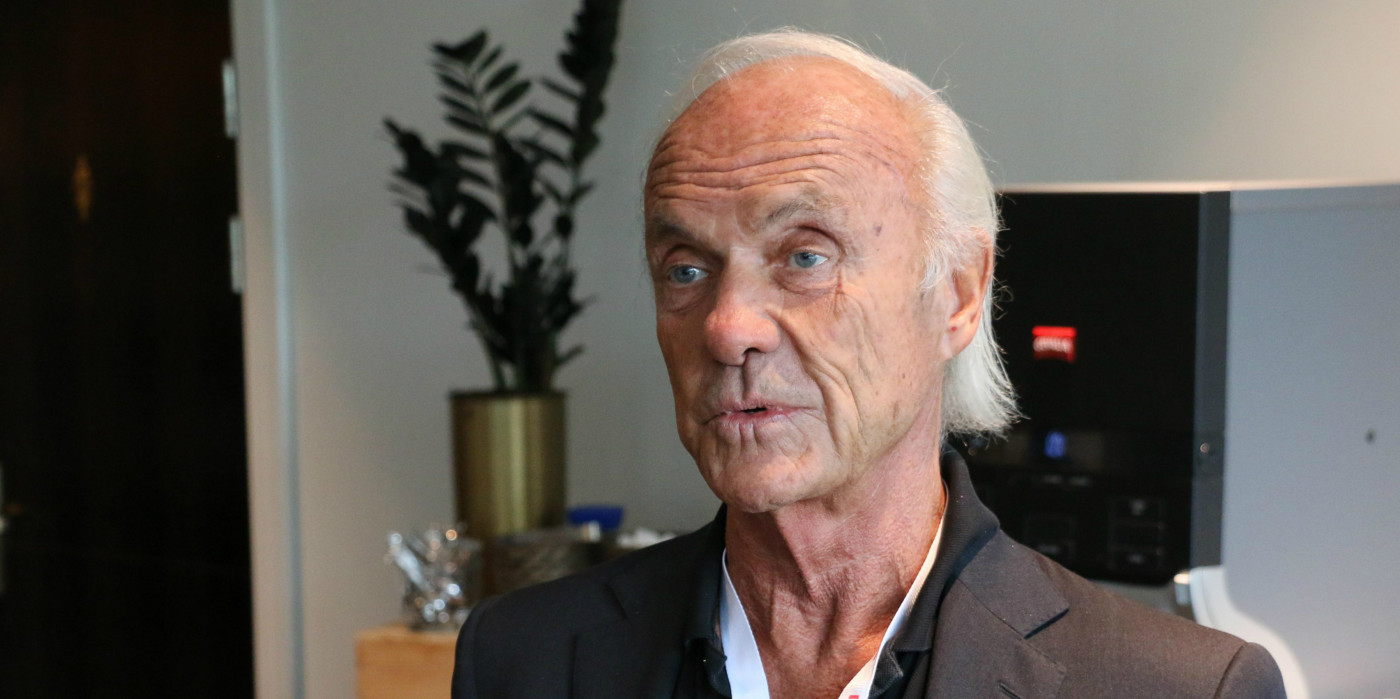

“It is an honor to Trevian to be able to build up a real estate investment company together with such well-established investors as Elo and AP1 who understand the great potential underlying in the growing cities outside Helsinki. We are also satisfied to get one of the biggest pension funds in Sweden and the Nordics as a partner investing in Finnish real estate markets,” says Reima Södervall, CEO of Trevian Asset Management Oy.

The establishment of the joint venture is subject to the approval of the competition authorities.

Joint Venture Established to Invest in Finnish Real Estate

Finland —

Elo Mutual Pension Insurance, Första AP-fonden (AP1) and Trevian Asset Management Oy have agreed to establish a joint venture company which invests in the Finnish real estate market.<br />

Finland —

Elo Mutual Pension Insurance, Första AP-fonden (AP1) and Trevian Asset Management Oy have agreed to establish a joint venture company which invests in the Finnish real estate market.<br />

2017-03-23

Maria Olsson Äärlaht

[email protected]

All Nordics

All Nordics

Sweden

Sweden

Denmark

Denmark

Norway

Norway