The acquisition was made on behalf of the global real estate fund manager’s core European property strategy, managed by David Jackson and Simon Ellis.

Located next to Stockholm’s Central Station, the 34,000 sqm building is multi-let to 30 tenants and has recently undergone significant refurbishment.

The deal marks M&G Real Estate’s largest single continental European acquisition, surpassing the EUR 208M acquisition of Market Central Da Vinci in Rome, a joint venture with GWM Group, announced earlier in the year.

M&G Real Estate’s existing portfolio in Sweden is comprised of 44,400 sqm of assets across the office, logistics and retail sectors, collectively valued at EUR 83M. Including assets in Denmark and Finland, its existing portfolio in the Nordics region is valued EUR 256M.

“This deal in Stockholm’s Central Business District is now our fund’s single largest acquisition to date, again considerably increasing our average transaction size. We continue to raise and deploy significant capital, targeting major European cities where prime assets in core locations benefit from strong rental growth and give our investors long-term income driven returns,” says David Jackson, fund manager at M&G Real Estate.

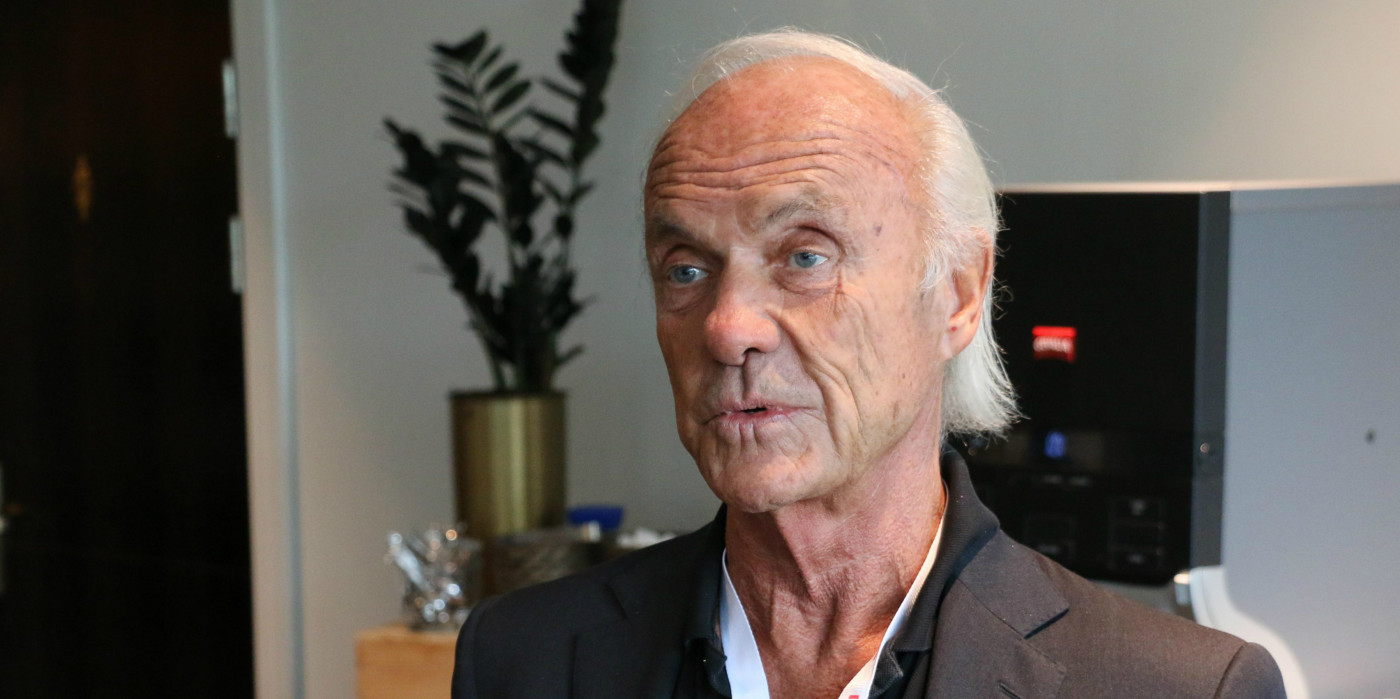

In August, M&G Real Estate announced that it had appointed Thorsten Slytå to manage Nordic assets, and support the investment ambitions of the business in this key European region, based out of M&G Real Estate’s new Stockholm office.

“Against the backdrop of Stockholm’s buoyant economy and office real estate market, demonstrated by the sector’s low vacancy rate of 3 per cent, rental growth is being pushed upwards and investor appetite remains strong for core assets. Blekholmen 1 provided a unique investment opportunity for our investors seeking access to this well-established market,” says Thorsten Slytå, Director, Nordic Region at M&G Real Estate.

M&G Real Estate Acquires for EUR 226M in Stockholm

Sweden —

M&G Real Estate, one of the world’s largest property investors, has acquired the leasehold of Blekholmen 1, an office scheme in central Stockholm for EUR 226M from Niam.<br />

Sweden —

M&G Real Estate, one of the world’s largest property investors, has acquired the leasehold of Blekholmen 1, an office scheme in central Stockholm for EUR 226M from Niam.<br />

2017-01-13

Maria Olsson Äärlaht

[email protected]

All Nordics

All Nordics

Denmark

Denmark

Finland

Finland

Norway

Norway