Savills European research team recorded the shopping centre investment opportunities across 23 European cities by analysing four types of market fundamentals: market size; market stability; retail prospects and potential returns. The cities analysed were Amsterdam, Athens, Berlin, Brussels, Copenhagen, Dusseldorf, Edinburgh, Helsinki, Krakow, Lodz, Lyon, Madrid, Manchester, Marseille, Milan, Munich, Oslo, Paris, Poznan, Stockholm, Vienna, Warsaw and Wroclaw.

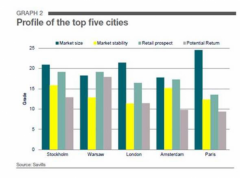

The Savills 2016 European Shopping Centre Investment Benchmarking report reveals that it is Stockholm, with its solid economic fundamentals, that comes out ahead of all other cities, closely followed by Warsaw, then by London, Amsterdam, and Paris.

Lydia Brissy, Director of Savills European research, comments: “Stockholm is the most well-balanced market in terms of size, stability, prospect and returns, which makes it a safe-haven and a target for the widest type of investors seeking to invest in shopping centres. Taking into consideration all of the factors that make up our benchmark results, Stockholm is the best performer and yields are also higher than in both other ‘safe haven’ cities of London and Paris.”

With a GDP per capita of EUR 59,000, Stockholm is a small but wealthy city and importantly the retail spend per inhabitant in Stockholm is EUR 10,080, the fourth highest, following Dusseldorf, London and Paris. Additionally, Savills notes that retail sales are expected to grow rapidly in Stockholm, by 2.6 percent pa on average until 2021. The firm also reports that both total shopping centre stock and stock per inhabitant are substantial in the city at 1.4m sq m and 635 sq m per 1,000 inhabitants respectively with stock expected to grow by 2.3 percent until 2018, which will provide investors with more investment opportunities.

Warsaw came a close second to Stockholm on the Savills Shopping Centre benchmark. “The typical profile of investors looking into the Warsaw shopping centre market is more opportunistic as market strength predominantly relies on retail prospect and potential returns,” adds Brissy. The annual retail sales volume in Warsaw is relatively small compared to other cities yet citizens of Poland’s capital have a high retail spend, which Savills highlights is particularly significant if you take into consideration their GDP per capita (EUR 31,730), which is relatively modest compared to most other European cities benchmarked in the report. In 2016, retail spend per inhabitant in Warsaw was on average EUR 9,740, which is the fifth highest of all 23 cities analysed. With retail sales expected to increase rapidly in the next five years, by 5.6 percent pa on average, the second highest growth expected after Kraków (5.6 percent), Warsaw will become the biggest retail spending city per inhabitant (EUR 11,650) by 2021. In addition, Savills reports that the vacancy rate is low and international brands are currently actively looking into the market. “Low unemployment, strong GDP growth ahead and a large population suggests the market size of Warsaw could compete with core markets in the short to medium terms,” notes Brissy.

For years London was leading all European cities in terms of shopping centre investment volume with Savills noting that in 2011, shopping centre investment in London accounted for 26 percent of the total accumulated in the 23 European cities covered in its report. Since the beginning of 2016, the London share decreased to approximately 9 percent while Krakow and Helsinki took the lead representing 22 percent and 13 percent of the total respectively. In terms of the Savills benchmarking results, London’s GDP per capita (EUR 89,400) is the highest in all 23 cities, with the volume of retail sales in London the second highest after Paris, and retail sale per inhabitant is also in second position after Dusseldorf (EUR 10,400). “It is however more volatile than Stockholm which can be good for short term investors”, says Brissy, “But what makes London so appealing to investors is its large market size and its GDP per capita (EUR 89,000), which is the highest of all cities analysed.”

Oli Fraser Looen, Director, Savills Cross Border Retail, comments: ‘Changes in demographics, urbanisation trends and evolving consumer behaviour are all reshaping the European retail sales landscape and as a result, we are seeing a shift in investor demand. This year we are expecting to see increasing appetite for shopping centres in the non traditional markets such as Warsaw and Amsterdam. With relatively small market sizes but solid market fundamentals, both are offering value for money for investors. We also believe that the Nordic market, particularly Stockholm, has the potential to attract investors with different profiles and strategies at competitive prices compared to the traditional norm offered by the likes of London and Paris. What we are seeing is the continuing trend of cross border activity as investors target centers with strong long term fundamentals as country boundaries are no longer being seen as a barrier to entry.”

Savills: Stockholm Tops the League of European Shopping Centre Hotspots for Investors

Sweden —

According to international real estate advisor Savills, Stockholm is currently the best European city for investment into shopping centres due to its "safe-haven" status, and its relatively wealthy population.

Sweden —

According to international real estate advisor Savills, Stockholm is currently the best European city for investment into shopping centres due to its "safe-haven" status, and its relatively wealthy population.

2017-01-19

Axel Ohlsson

[email protected]

All Nordics

All Nordics

Denmark

Denmark

Finland

Finland

Norway

Norway