The portfolio consists of 34 properties, of which 18 are standing assets with 680 homes, including one commercial property. 16 properties are under construction and are acquired in a forward purchase structure with turnkey delivery within the next 24 months. The transaction is structured as multiple share deals and closes 13 August.

The properties complement Heimstaden’s existing geographical footprint and operational platform with property- and facility management capabilities across Denmark. The properties are located mainly in Jutland with two properties located on Funen.

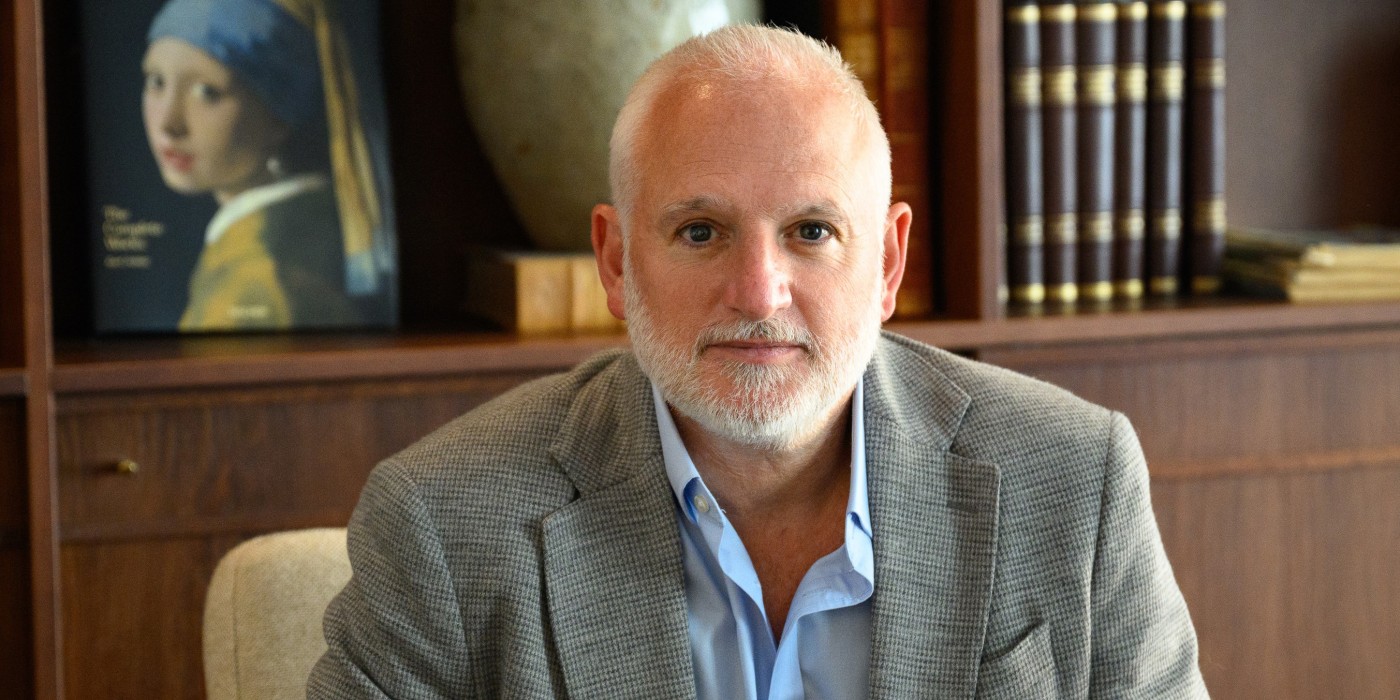

“We are pleased to further strengthen our presence and exposure to strong Danish housing markets. This acquisition is a good fit with our strategy to expand our portfolio in and around growth cities across Denmark, where we also contribute to local value creation," said Christian Fladeland, Co-Chief Investment Officer at Heimstaden.

The residential portfolio mainly consists of terraced and semi-detached houses in or near medium sized Danish cities, such as Vejle, Herning and Holstebro.

The portfolio, including projects under construction, has an estimated gross rental income (GRI) p.a. of SEK 186 million and net operating income (NOI) p.a. of SEK 148 million on a fully let basis. 15% of residential income is from regulated units.

“We aim to provide Friendly Homes for customers in all stages of life and contribute to a healthy housing market. We already have a significant presence in Jutland and Funen and the new properties complement our existing portfolio well with an opportunity for operational synergies,” said Michael Byrgesen Hansen, Country Manager at Heimstaden Denmark.

Heimstaden Bostad was advised by Gorrissen Federspiel and CBRE.

All Nordics

All Nordics

Sweden

Sweden

Denmark

Denmark

Finland

Finland

Norway

Norway