Located in Frederiksberg, a thriving neighbourhood in Copenhagen, Mariendalsvej 55-57 covers a total area of 13,901 square metres, consisting of two adjacent living properties to include 38 student housing units and 50 residential homes. In addition, the sites’ retail space of 166 square metres, has just been leased by Food Family ApS. Hines negotiated and signed a lease with this contemporary food operator whilst undertaking the acquisition, meaning the asset is now 100% let.

Completed in 2019, Mariendalsvej 55-57 is located in an affluent residential area close to several higher education institutions, including Copenhagen Business School and the University of Copenhagen. Frederiksberg is well-known for its many parks and green areas -and is a short walk to the metro, shopping, dining and cultural attractions. The location typical appeals to a younger demographic of discerning residents and individuals. In addition, the property is EPC A rated and includes rooftop photovoltaic cells. The property has been financed (by a ‘green bond’ financing system – recognition of the asset’s sustainable credentials.

This acquisition further underlines HECF’s focus on the Nordics following three completed acquisitions in the region during the last two years. Renewed investment appetite is driven by the healthy demographic, its economic and political stability, and the increasing investment liquidity observed in the region.

This acquisition marks HECF’s fifth living purchase, aligning with its ongoing strategy to increase exposure to family-oriented residential assets in key European city markets with strong long-term growth prospects. It represents the latest in a string of HECF living deals which include a recent acquisition in Dublin and the acquisition of a mixed-use scheme in Cologne, Germany which had a significant residential component.

CBRE advised the vendor on the transaction.

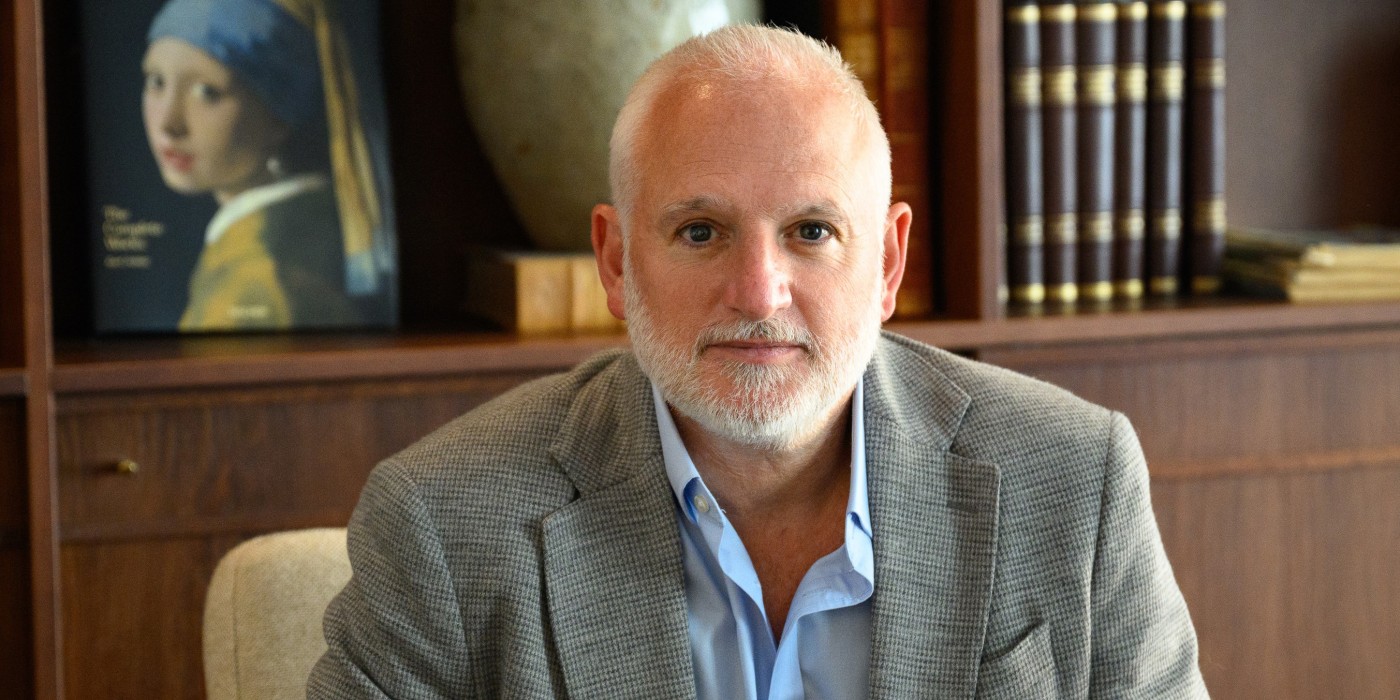

Simone Pozzato, Managing Director and HECF Fund Manager, at Hines, said:

“We continue to broaden our exposure to the living sector, driven by the strong fundamentals of some European cities which continue to grow at rapid pace but are severely undersupplied in terms of residential stock. Mariendalsvej 55-57 is a very attractive investment due to its prime urban location, strong market fundamentals and its ability to meet the needs of both residents and students. It is rare to acquire an existing but modern high-quality scheme in such a prominent location. The Fund will continue to target these type of investment opportunities and the Nordic region offers strong risk-adjusted returns for core investors who have local experts like James Robson and his team present on the ground.”

James Robson, Senior Managing Director and Country Head – The Nordics, at Hines, commented:

“We are very pleased with the acquisition of Mariendalsvej 55-57. It’s a gem of a location and our second living asset in Denmark and once again demonstrates our long-term commitment to the Nordics. We believe there is ample appetite for quality living spaces and student accommodation in Denmark that is centrally located with excellent transport and connectivity links, underpinned by ESG and wellness credentials. We will continue to seek out similar living opportunities, on or off market, as we continue on our growth trajectory.”

Anette Grotum, Senior Director at CBRE, added:

”This is a prime property in a prime location and it has also been felt on the interest. Many domestic and foreign investors are looking for this type of property - and with good reason, because these are solid investments.”

All Nordics

All Nordics

Sweden

Sweden

Denmark

Denmark

Finland

Finland

Norway

Norway