CapMan Nordic Property Income Fund (“CMNPI”) has acquired a light industrial property with a public sector tenant, in Aarhus, Denmark. The property, Sintrupvej 17-19, covers altogether c. 4,600 m2 of leasable space. It is located in Brabrand, Aarhus, a predominantly light industrial and logistics area with office and residential properties nearby. Brabrand is part of Aarhus municipality, just 7 km west of Aarhus city centre, which is accessible by car in approx. 15 min or by bike in 25 min and has easy access to public transportation. The asset is a multi-let property where the largest tenant is Aarhus Municipality on a long-term lease.

In addition to standard maintenance and refurbishments, CapMan plans to improve long-term sustainability of the property by investing in energy savings measures and is looking to certify the property in the future.

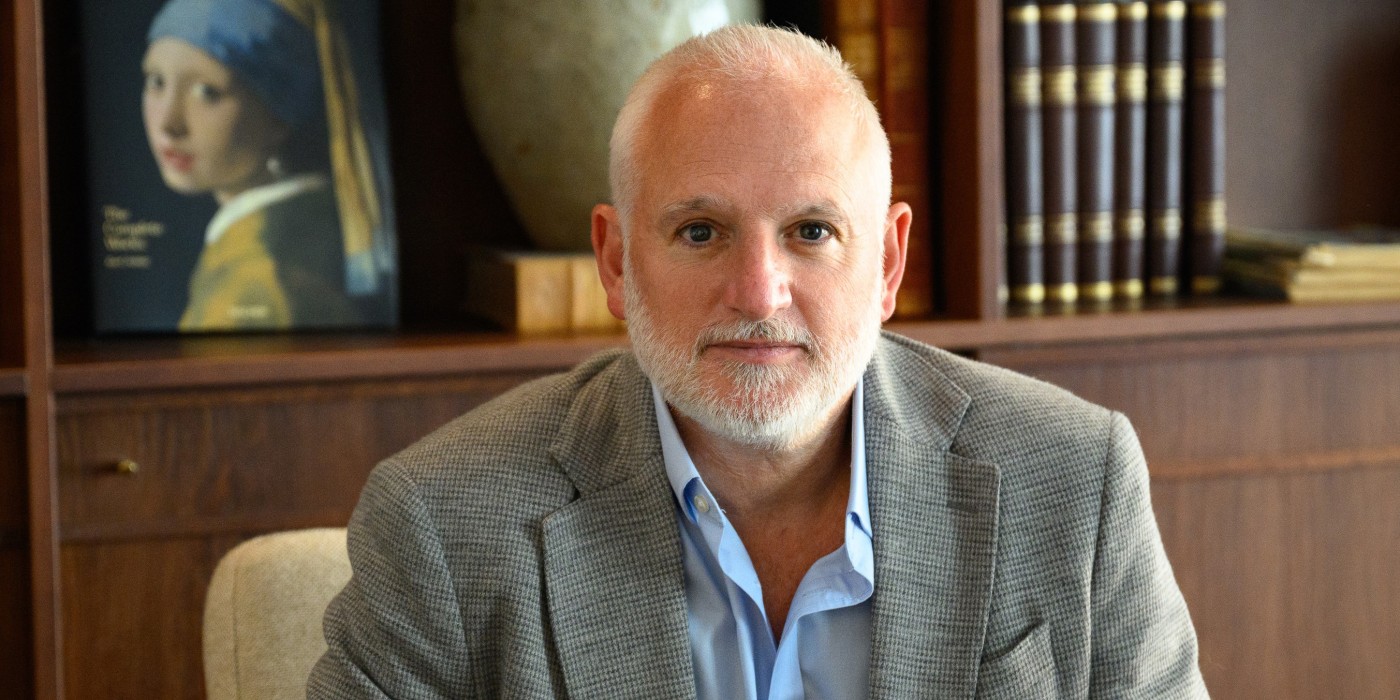

”We are very pleased about this addition to our income-focused fund. The Aarhus market for light industrial properties is experiencing great demand and this well-located and functional property is ideally positioned to benefit from this,” shares Peter Gill, Partner, Head of CapMan Real Estate Denmark.

”This is an excellent addition to the fund and to its growing warehouse portfolio, and also a demonstration of our local reach in the Nordics. Despite of a more challenging market there are opportunities to be found. Long-term income derived from a light industrial asset with a municipal tenant is a perfect fit for the fund,” shares Sampsa Apajalahti, Investment Director at CapMan Real Estate and Fund Director of CMNPI.

The property was acquired from Hermod Ejendomme A/S. The acquisition was secured and facilitated in cooperation with Rubik Properties, a leading international operating partner in Denmark.

CapMan Nordic Property Income Fund is a non-UCITS active open-ended fund that distributes a minimum of 75% of its annual realized profit to its unit holders. The fund focuses on stable income generating properties such as light industrial and warehouse properties, modern offices, necessity-driven retail assets and niche properties in the living sector in most liquid Nordic cities with solid long-term growth fundamentals. The fund accepts new subscriptions on a quarterly basis and targets 7% annual net return.*

CapMan Real Estate currently manages approximately EUR 4.5 billion in real estate assets and the Real Estate Team comprises over 65 real estate professionals located in Helsinki, Stockholm, Copenhagen, Oslo and London.

All Nordics

All Nordics

Sweden

Sweden

Denmark

Denmark

Finland

Finland

Norway

Norway