The property is a large domicile property of approx. 50,000 m2 let to the global pharmaceutical company Novo Nordisk A/S listed on Nasdaq Copenhagen and NYSE. The property consists of three large office buildings and parking facilities for 1,030 cars. The office buildings are connected and constructed in three phases in 2006, 2009 and 2015 respectively, in cooperation with Novo Nordisk, who has always occupied the property. The property is located in Søborg at Vandtårnsvej 110, 112 and 114 and a multi-storey car park facility at Rosenkæret 1-9. The property is constructed in a very high quality and with focus on indoor climate.

Danny. K. Y. Kim, CEO, AIP Asset Management, comments: "Novo Nordisk office acquisition demonstrates our interest and ability to close prime assets in Denmark and other Nordic countries. We are proud to be the first and will be the most experienced Korean asset management company working closely with our valued local partners in this market."

The property is acquired at a price of DKK1,200 million (approx €160 million) Seller is a company owned by the Danish institutional investors Velliv, TRYG, PBU and AP Pension, who were advised by CBRE.

Buyer has been advised by KanAm, Bruun & Hjejle and Fokus Asset Management, and has entered into a property management agreement with the latter.

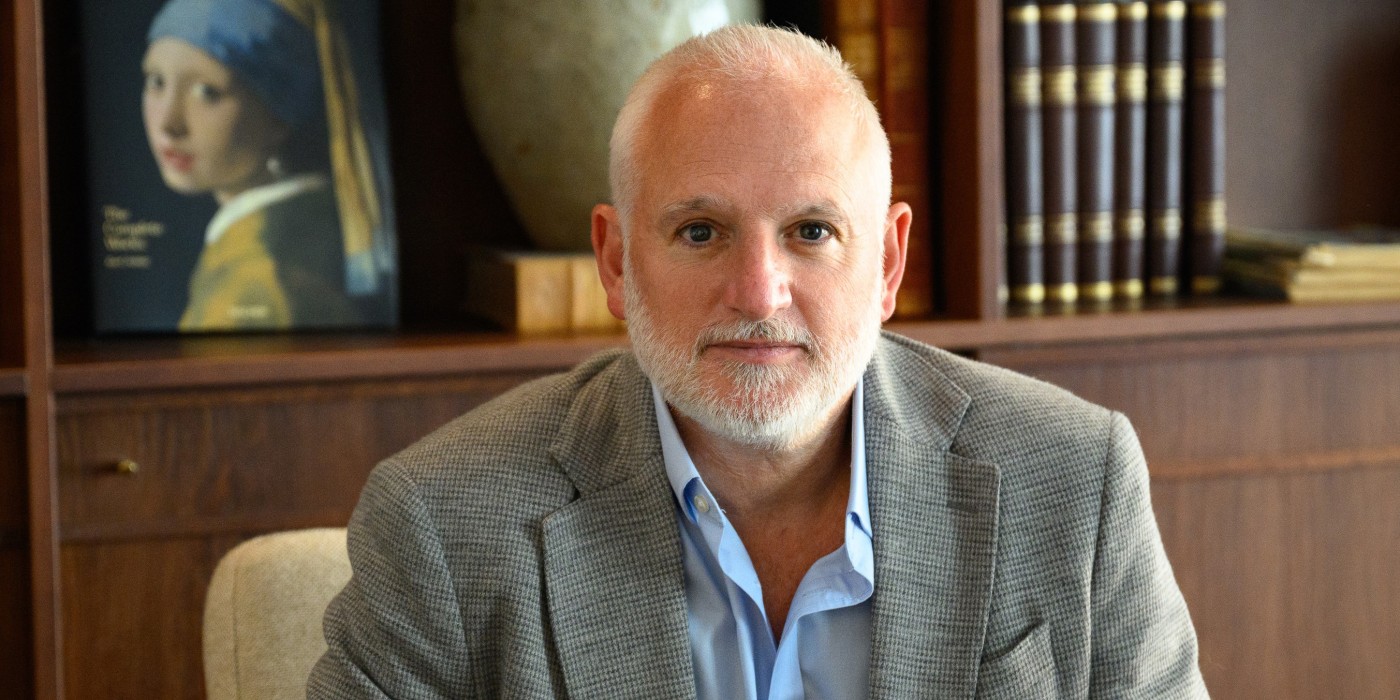

”We are exceedingly proud about the international cooperation in connection with this transaction and have great respect for AIP’s in-depth and detailed approach to their first property investment in Denmark”: comments Tonny Nielsen, CEO / Partner, Fokus Asset Management A/S in this connection.

South Korean AIP Makes Their First Investment in Denmark

Denmark —

South Korean AIP Asset Management has acquired a large office property in Søborg (Copenhagen). This investment is AIP’s first property investment in Denmark and the Nordics.

Denmark —

South Korean AIP Asset Management has acquired a large office property in Søborg (Copenhagen). This investment is AIP’s first property investment in Denmark and the Nordics.

2018-12-28

Victor Friberg

[email protected]

All Nordics

All Nordics

Sweden

Sweden

Finland

Finland

Norway

Norway