“The interest for the Nordic region as a whole is very strong at the moment, both from international and pan-Nordic investors”, says Mikael Söderlundh, Head of Research and Partner at Pangea Property Partners.

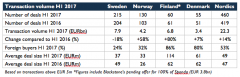

Growth was partly driven by the Norwegian market with a transaction volume of EUR 4.2 billion in the first half of 2017, which is 58 percent higher than last year. The Finnish market also contributed with a transaction volume increasing by 80 percent, mainly because of the acquisition of listed property company Sponda.

The largest sector in the first half of 2017 was office accounting for 38 percent of the Nordic transaction volume, followed by residential accounting for 22 percent and retail accounting for 15 percent. The average transaction size amounted to EUR 49 million, which is slightly higher than last year.

“Private investors and property funds were particularly active on the buy side, while listed property companies were large net sellers,” adds Mikael Söderlundh.

The largest property transactions in the Nordic region in the first half of 2016 were:

- Blackstone/Areim acquiring Finnish listed company Sponda (EUR 3.8bn)*

- Heimstaden Bostad acquiring several residential portfolios in Sweden, Norway and Denmark (EUR 0.8bn)**

- Samhällsbyggnadsbolaget acquiring DNB’s head quarter in Oslo from Meteva (NOK 4.3bn)

- Niam acquiring 2,000 apartments in Denmark from HD Ejendomme (DKK 4.2bn)

- DCC Energy acquiring 142 assets in Norway from ExxonMobil (NOK 2.4bn)

- CBRE GI acquiring retail park Bromma Blocks in Stockholm from Starwood (SEK 2.3bn)

* Offer for entire company still pending, expected closing July 2017

** Adjusted for ownership change before and after the deal

During the first half of 2017, Pangea Property Partners executed more than 30 transactions and other advisory mandates in the Nordics with an underlying property value above EUR 1.1 billion. For example, the company advised Nordic Choice/Strawberry Properties in the large hotel establishment on Copenhagen Airport, Skanska in the sale of Flemingsbergdalen in Stockholm and Fem Hjärtan in the sale of 10 properties in Halmstad, the largest transaction ever done in this Swedish town.

“With our pan-Nordic reach and local market knowledge combined with our presence in London, our ambition is to offer the very best transaction services to national and international property investors in the Nordic region. We are extremely proud of the trust given to us by leading clients over the past years,” says Bård Bjølgerud, CEO and Partner at Pangea Property Partners.

All Nordics

All Nordics

Sweden

Sweden

Denmark

Denmark

Finland

Finland

Norway

Norway