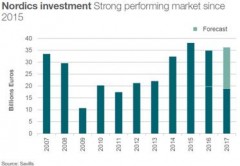

Sweden and Norway were the principle recipients of international money, accounting for 66 percent of total cross border volume, according to Savills. Overall total investment volume in the Nordics reached EUR 19 billion in H1 2017, slightly lower than the record high reached in the same period last year, however Savills expects full-year volumes to reach EUR 33 billion, an increase of 4 percent on 2016’s total.

H1 investment in Denmark reached a new H1 record this year at EUR 4.2 billion, 19 percent up on the same period in 2016, says Savills, while in Norway H1 2017 turnover almost doubled to EUR 4.4 billion as a result of a surge of investment into the hotels sector. Half year investment in Sweden reached EUR 7.8 billion, down on 2016 levels, but still 19 percent higher than the five-year H1 average, while activity in Finland decreased 32 percent during H1 due to a lack of available prime opportunities.

According to Savills research, offices remain the preferred investment sector, accounting for 34 percent of all H1 investments in the Nordics, down slightly from 39 percent in H1 2016. The ‘multi-family’ sector saw a 3 percent rise in investment on the same period last year, accounting for 28 percent of the market and receiving EUR 5.4bn, ahead of retail (22 percent market share, up from 17 percent) and logistics (10 percent).

Lydia Brissy, European research director at Savills, comments: “The highly urbanised nature of the Nordics, combined with population growth, is driving a need for professionally managed residential accommodation of different tenures and sizes in major cities such as Copenhagen and Helsinki, and this has caught investors’ interest sending volumes up. Meanwhile, strong investor appetite for offices last year saw the average Nordics prime office yield move in to 3.75 percent. This is still more attractive than prime office yields in core European countries such as France and Germany, so the sector continues to attract strong investment, but it has did lead to some buyers exploring what other opportunities there were in the marketplace, hence the rise of multi-family.”

Peter Wiman, Savills acting head of Swedish investment, adds: “Overall the property fundamentals of the Nordics are solid, with the region offering an alternative option to core European destinations, given its very competitive pricing. As in any other European markets, alternative assets such as multi-family will continue to capture a growing share of total investment, but we forecast that senior housing in Finland, Sweden and Norway, student housing in Denmark, and the hospitality sector in Norway will also grow in popularity, albeit offices will probably continue to prevail in the face of strong rental growth.”

Cross-Boarder Investment in Nordics Surges 23 percent

Nordic —

Cross-border investment into Europe's Nordic countries (Denmark, Finland, Norway and Sweden) rose to EUR 5.5 billion in the first half of 2017, 23 percent up on the same period in H1 2016. This represents a 29 percent share of the total volume invested in the Nordics in the year to date, according to research by international real estate advisor Savills.

2017-08-09

Axel Ohlsson

[email protected]

All Nordics

All Nordics

Sweden

Sweden

Denmark

Denmark

Finland

Finland

Norway

Norway