Sverige står sig bra i en global analys-rapport från TIAA Henderson.

Image: Pixprovider/David Schmidt.

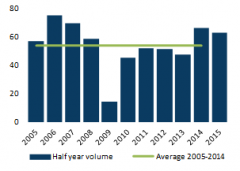

Transaction Volume During the First Half of 2015 just over €6,8 Billion

Sweden —

After an average first quarter with a transaction volume of just over €2,38 billion the activity accelerated in the second quarter which ended at nearly €4,44 billion. This gives a six-month volume 2015 of just over €6,8 billion, which is significantly higher than the average H1 volume over the last ten years, which is €5,85 billion. Yet the H1 2015 volume is not as high at the 1H volume last year which was nearly €7,15 billion.

Sweden —

After an average first quarter with a transaction volume of just over €2,38 billion the activity accelerated in the second quarter which ended at nearly €4,44 billion. This gives a six-month volume 2015 of just over €6,8 billion, which is significantly higher than the average H1 volume over the last ten years, which is €5,85 billion. Yet the H1 2015 volume is not as high at the 1H volume last year which was nearly €7,15 billion.

2015-07-02

The largest segment in the first half was residential, whose share was 26%. Retail was the second largest segment with a share of 20%. Office, which is usually the largest or second largest segment ended up as number three with 16% of the transaction volume. Industrial and logistics properties share was 15%.

Stockholm and the property markets outside the metropolitan areas attracted most capital during the half year. Stockholm accounted for about 32% of the investment volume and markets outside the metropolitan areas captured 16%. Västra Götaland’s share was 13% and Skåne just over 12%.

"Transaction activity has continued to spread into new sectors and second tier markets across the country. There are a few reasons for this. Firstly the tough competition is forcing investors to widen their investment criteria. Moreover, there are today several investors who are focusing on property segments that the market previously neglected, for example, hotels, public buildings and supermarkets. The risks that were previously associated with these segments have diminished as the knowledge of the segments has grown", says Karin Witalis, Head of Research at DTZ in Sweden.

"The transaction year 2015 has had a powerful start and the forecast for the rest of the year is in line with last year. Competition is fierce, interest rates low and financing opportunities remain favourable. At the same time there are a number of macro risks that could change the market situation. For investors in real estate it is important to have a long term view and consider various future scenarios", says Agneta Jacobsson, Managing Director at DTZ in Sweden.

Stockholm and the property markets outside the metropolitan areas attracted most capital during the half year. Stockholm accounted for about 32% of the investment volume and markets outside the metropolitan areas captured 16%. Västra Götaland’s share was 13% and Skåne just over 12%.

"Transaction activity has continued to spread into new sectors and second tier markets across the country. There are a few reasons for this. Firstly the tough competition is forcing investors to widen their investment criteria. Moreover, there are today several investors who are focusing on property segments that the market previously neglected, for example, hotels, public buildings and supermarkets. The risks that were previously associated with these segments have diminished as the knowledge of the segments has grown", says Karin Witalis, Head of Research at DTZ in Sweden.

"The transaction year 2015 has had a powerful start and the forecast for the rest of the year is in line with last year. Competition is fierce, interest rates low and financing opportunities remain favourable. At the same time there are a number of macro risks that could change the market situation. For investors in real estate it is important to have a long term view and consider various future scenarios", says Agneta Jacobsson, Managing Director at DTZ in Sweden.

Eddie Ekberg

[email protected]

All Nordics

All Nordics

Denmark

Denmark

Finland

Finland

Norway

Norway