The six properties, combined constituting the former headquarters of the LB Group, are located in the the Copenhagen city centre, at Farvergade 2-8 and 17, Kompagnistræde 41 and 43, Kompagnistræde 39/Vandkunsten 8 and Vandkunsten 10. Overall, the portfolio comprises some 15,000 sq m floorspace, mainly office space.

“It was not without sadness that we left Farvergade and the surrounding buildings, where LB Forsikring has resided since 1957. We were therefore delighted with the exceptionally strong interest for the portfolio both from domestic and foreign investors. Altogether, we received about 20 bids to acquire the portfolio, and we are satisfied with the outcome,” states Jan Kamp Justesen, CFO with LB Forsikring A/S.

The buyer of the Portfolio is domestic listed property company Jeudan A/S at a total price of more than DKK 400 million.

Colliers was sell-side advisor on the sales transaction.

LB Forsikring A/S decided to sell the portfolio as the company recently relocated to new headquarters on the Copenhagen waterfront at Amerika Plads, where the Group’s almost 800 employees now work from the same premises as opposed to various locations, which was the case prior to the relocation.

Although the marketing of the portfolio was initiated during the lockdown due to COVID-19, the portfolio attracted substantial interest in the investor community.

“For some time now, the office market has been characterised by strong demand, driving up rental prices and driving down yield requirements. Whereas investor activity in a historical context has been concentrated on relatively new office properties in Copenhagen’s development areas, we currently witness a stronger focus on central locations,” says Jacob Bruun Borring, Manager of Colliers Capital Markets, facilitating the sale.

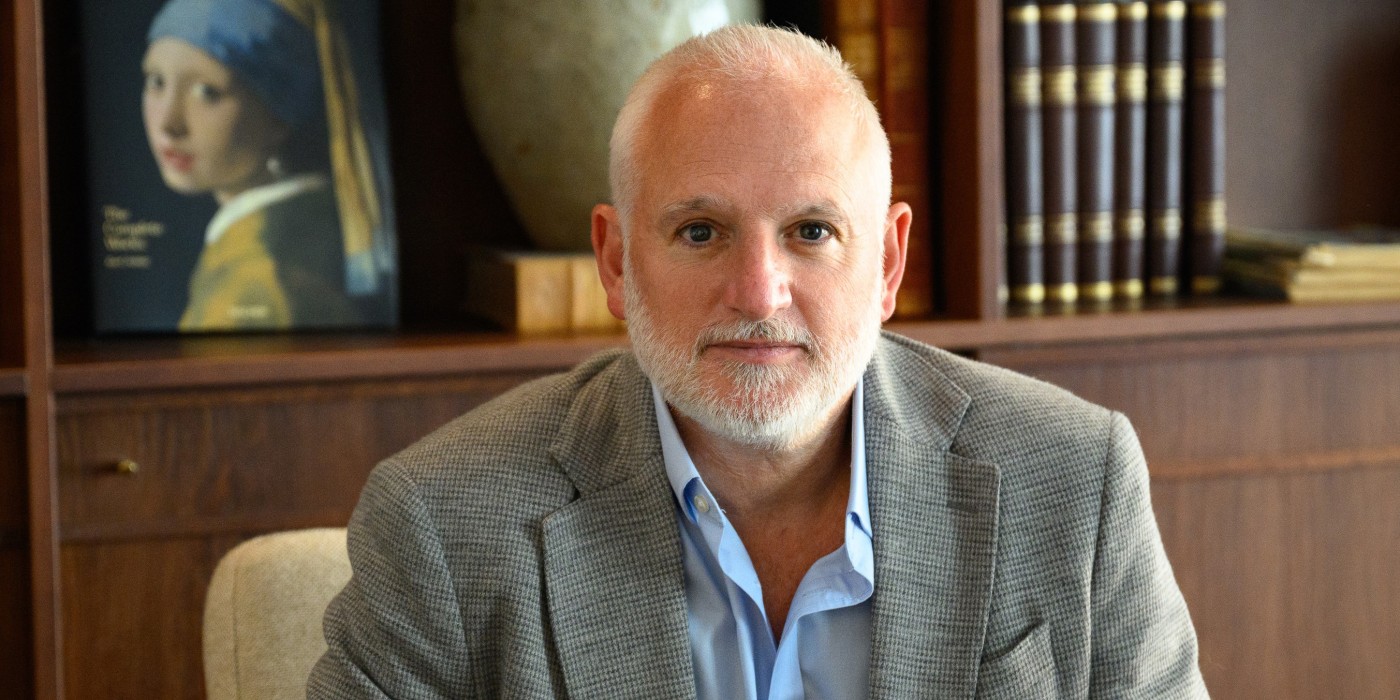

“The transaction once again confirms the fact that the Danish property market remains highly interesting to foreign investors. A number of bids came from investors with no previous investments in the Danish market, and although it was a domestic buyer that secured this particular portfolio, we expect several new investors to enter the Danish market in the years ahead,” says Peter Winther, CEO of Colliers Denmark.

All Nordics

All Nordics

Sweden

Sweden

Denmark

Denmark

Finland

Finland

Norway

Norway