PFA is now investing directly in properties in France for the first time. Three investments totaling approx. DKK 3.4 billion, which is at the same time a central extension of PFA's investments in foreign properties.

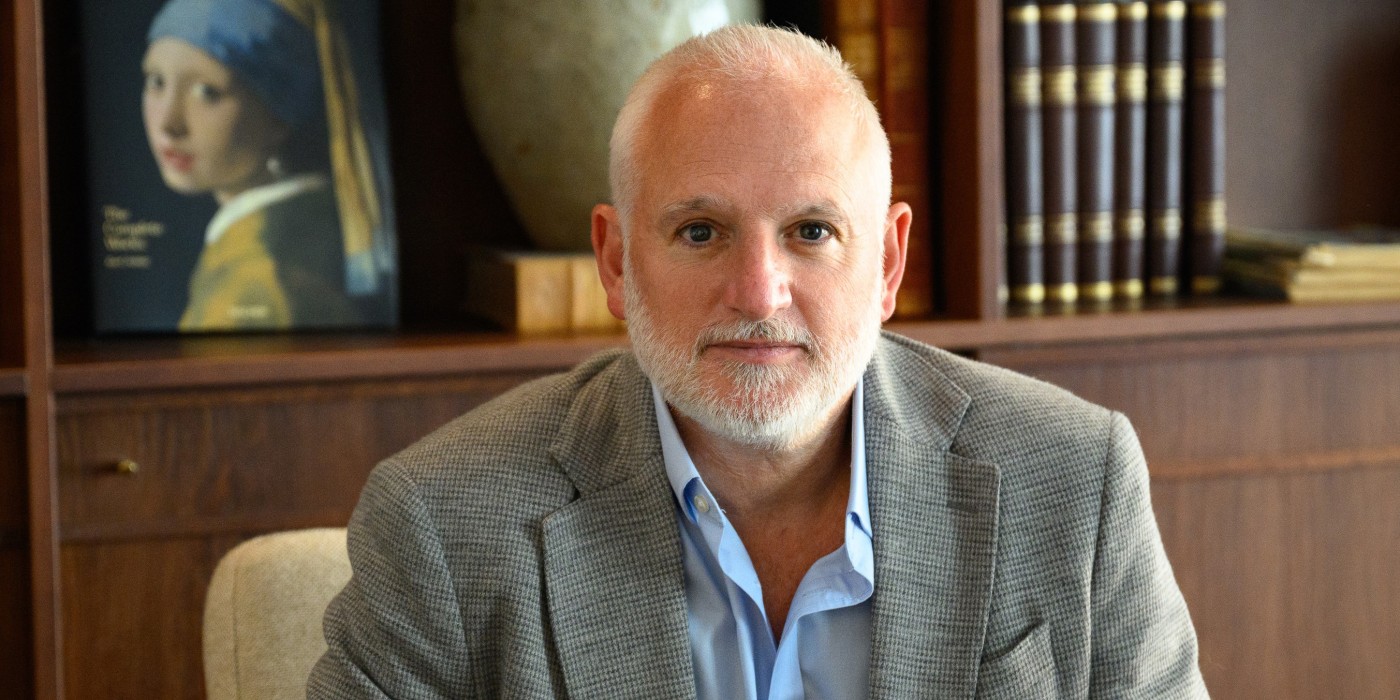

“Part of our investment strategy is to increase our real estate investment outside Denmark. And as part of that strategy, it has been natural to look for investment in France, which is among Europe's largest and leading economies. Here, the three investments fit perfectly, and with them our portfolio of foreign real estate investments is now at approx. DKK 35 billion," says Michael Bruhn, PFA's Real Estate Director.

Specifically, PFA invests in a historic office and residential property in the center of Paris, in serviced senior housing across France, and in logistics properties in well-established French logistics areas.

“Investments in France are all focused on megatrends. Eg. contributes to the investment in senior housing to meet the growing need for serviced senior facilities resulting from an aging French population. All in all, these are three solid and long-lasting investments that will make a positive contribution to the return on customers' pension savings," says Michael Bruhn.

PFA invests just under DKK 1.9 billion in the classic estate Square d'Orleans in Paris. The property is centrally located in the French capital, where there is a limited supply and high demand for both offices and housing. The property is approx. 13,700 sqm spread over approx. 5,500 sqm of accommodation and approx. 8,200 sqm office. The property is being renovated and remodeled over a long period of time and thus transformed into a modern and inspiring co-working/co-living property.

PFA invests approx. DKK 750 million in a separate mandate within serviced senior housing, where it is expected to achieve a portfolio of approx. 1,300 senior residences spread across 10-15 properties across France. There is ongoing investment in senior housing properties that are either listed and need to be developed or delivered completed. All properties are rented out to a professional operator who provides a range of services. The residences target the group of so-called independent seniors.

The background is that the number of older people over 75 is increasing sharply in France, where the number of independent seniors in particular is growing significantly.

The logistics sector in France is expected to experience continued growth with increased demand. supported by increasing e-commerce. In addition, the French logistics market is characterized by a limited supply of especially modern and efficient logistics properties.

In this connection, PFA invests approx. DKK 750 million in a separate mandate within logistics properties in France. There is ongoing investment in logistics properties that are either listed and need to be developed or delivered completed. Geographically, the focus is on logistics properties located near city centers, ports and airports in well-established French logistics areas and cities such as Bordeaux, Lyon, Lille and Paris.

All Nordics

All Nordics

Sweden

Sweden

Denmark

Denmark

Finland

Finland

Norway

Norway