The property, which is a mixed property of a total of 2,162 sq m, has an attractive location in inner Copenhagen. The property needs to be redeveloped where the office space is converted into housing. The property is listed in 1800, listed and divided into condos.

For 2019, Copenhagen Capital expects a profit of between DKK 9.0 and DKK 12.0 million. DKK before value adjustments of the company's properties, adjustment of debt at market value and tax. Positive value adjustments are also expected in 2019, assuming unchanged return requirements in the market.

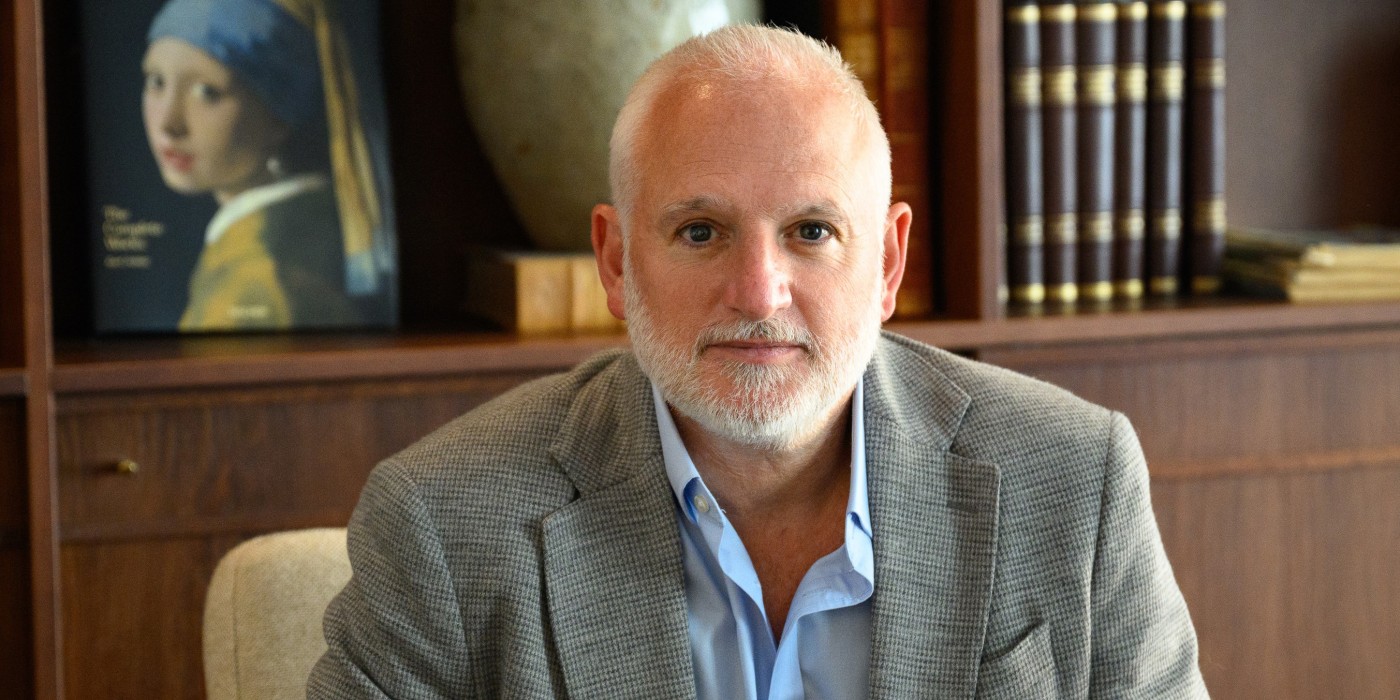

“Læderstræde 11 is an exciting property with great development potential that we expect to be able to add value,” comments Lars Falster, CEO of Copenhagen Capital and continues:

“We are experiencing an increasing interest from capital-intensive family-owned companies that can see Copenhagen Capital as a possible partner in the Copenhagen real estate market, which we have opened up with the agreement with Helmersen Holding”.

“For a long time we have followed the positive development of Copenhagen Capital, and have chosen to enter into a long-term and strategic collaboration with the listed real estate company, which we believe has strong real estate skills that can support our company in real estate trading property,” states co-owner and CEO Peter Helmersen, Helmersen Holding, and adds:

"We are looking forward to the collaboration in the development of Læderstræde 11".

All Nordics

All Nordics

Sweden

Sweden

Denmark

Denmark

Finland

Finland

Norway

Norway