Over the past few years, Thylander has developed and executed a new strategy for the properties by ensuring full letting and carrying out thorough renovation and updating the building stock to modern standards.

“The existing buildings had a significant maintenance backlog and a high vacancy rate. We have been working on the case for a couple of years and we have invested a lot in development and sustainable initiatives, such as renovation and energy optimization of the climate screen and outdoor areas. The result is full leasing – including a state-of-the-art and up-to-date new domicile for Zealand Pharma,” says Frederik Wiidau, project development director at Thylander.

Thylander has been assisted by CBRE and DLA Piper as advisors in connection with the sale. The buyer AEW, which is a global real estate investment fund with a total AUM of more than 80 billion dollars with 15 offices and 700 employees worldwide, has been assisted by Bech-Bruun, KHR and Colliers.

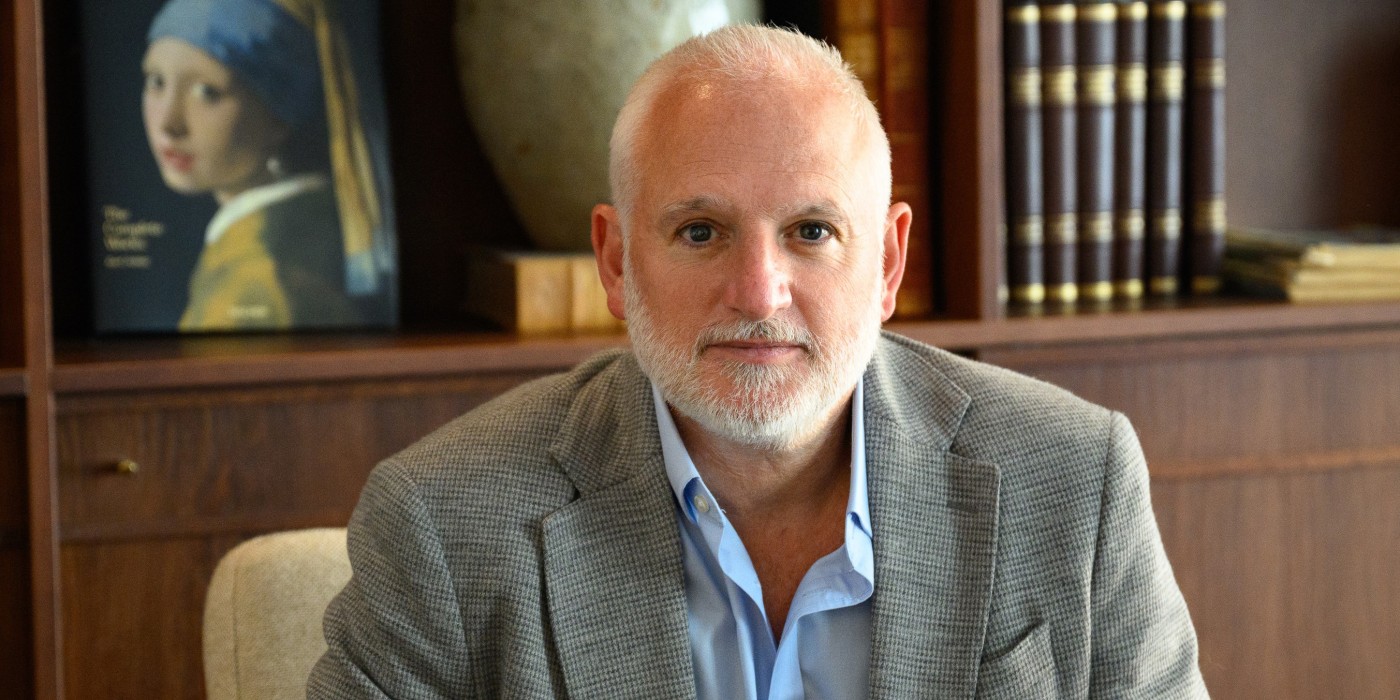

“The transaction and development process is a classic example of how we create added value – in this case by ‘reposition to core’ and hands-on active management. There was significant interest from both national and global investors and this transaction puts an end to a process that, despite high complexity, has been executed perfectly. A big thank you to our skilled employees involved in this case as well as our colleagues at Sophienberg Gruppen,” says director and partner in Thylander, Henrik Køhn.

The properties were acquired in 2018 from Altor Equity Partners as a Club Deal with Thylander and two private investors.

All Nordics

All Nordics

Sweden

Sweden

Denmark

Denmark

Finland

Finland

Norway

Norway