The projects are located in three regional growth cities in Jutland and represent 29,000 sqm. The properties are expected to be completed in 2022 and 2023 and will be DGNB certified. The acquisition is the second portfolio transaction, with Goldman Sachs having earlier this year acquired 9 properties covering 7 projects across growth cities in Jutland.

The three residential projects are located in three regional growth cities in Jutland, respectivelyHorsens, Kolding and Randers. The 29,000 residential sqm are spread across three properties and more than 365 residential tenancies with average sizes of approximately 79 m2.

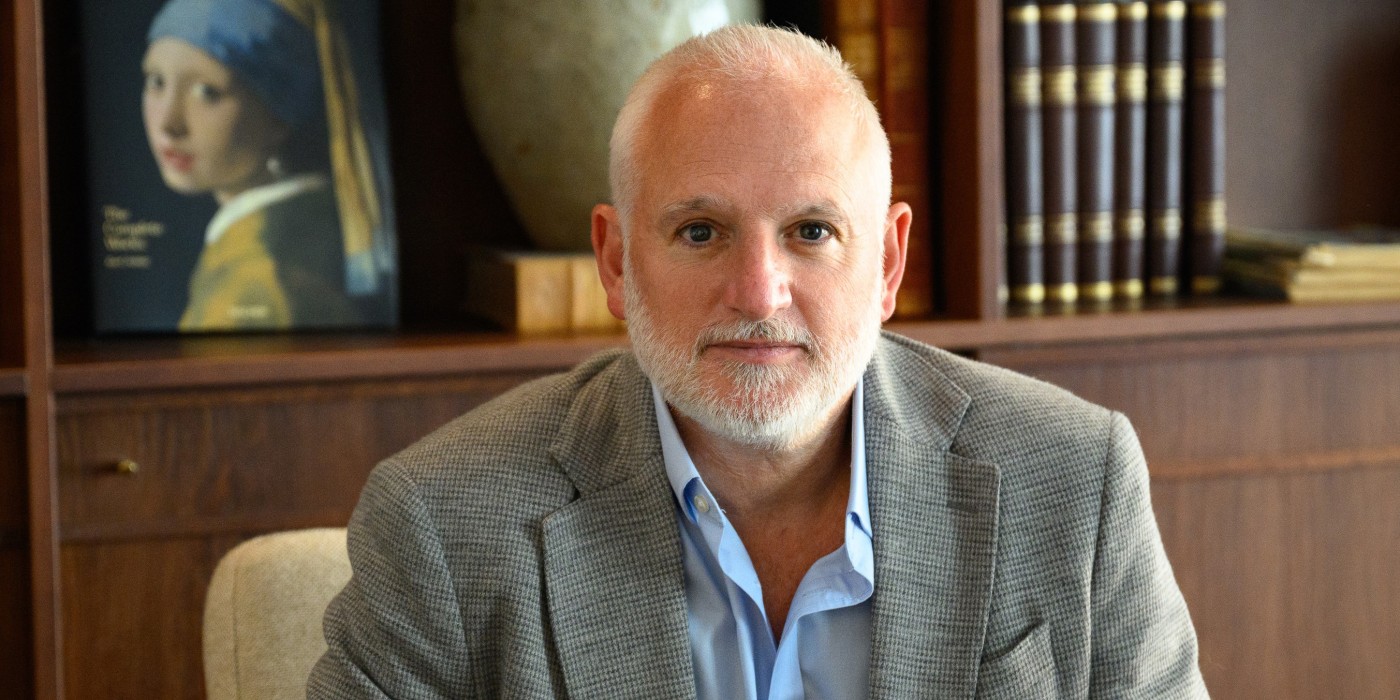

“We are pleased to expand our Danish residential strategy together with Rubik Properties and work with Birch Ejendomme again to deliver newly built and DGNB certified residential apartments at affordable rents, to the benefit of local communities” said Henrik Ohlsen, Executive Director in the Real Estate business within Goldman Sachs Asset Management.

Goldman Sachs and Rubik Properties were advised by resp. Brunn & Hjejle, KPMG, NIRAS and Colliers. Birch Properties was advised by Accura.

”We are very pleased to extend our good and close relationship with Rubik Properties and Goldman Sachs – a professional and well-reputed international investor – by yet another transaction so soon after our first joint transaction. This follow-up investment comes in the wake of the establishment of a close and trust-based collaboration among the parties which we established during the first transaction, and it supports our ambition to deliver affordable and sustainable quality buildings to the residential market in Danish growth cities,” says Thomas Bertelsen, Partner in Birch Ejendomme.

All Nordics

All Nordics

Sweden

Sweden

Denmark

Denmark

Finland

Finland

Norway

Norway