The properties are located in Denmark and are rented out with an average lease length of 5.3 years with, among others, Coop Denmark, Salling Group, Dagrofa and Reitangruppen as tenants. The rentable area amounts to approximately 76,600 square meters. Cibus intend to enter into a binding agreement regarding the acquisition prior to the commencement of trading on Nasdaq Stockholm on 25 March 2022, conditioned upon the Company's financing being secured through a directed share issue carried out by way of an accelerated bookbuilding procedure, which will be announced through a separate press release in connection herewith. Closing of the Transaction is estimated to take place on 6 April 2022.

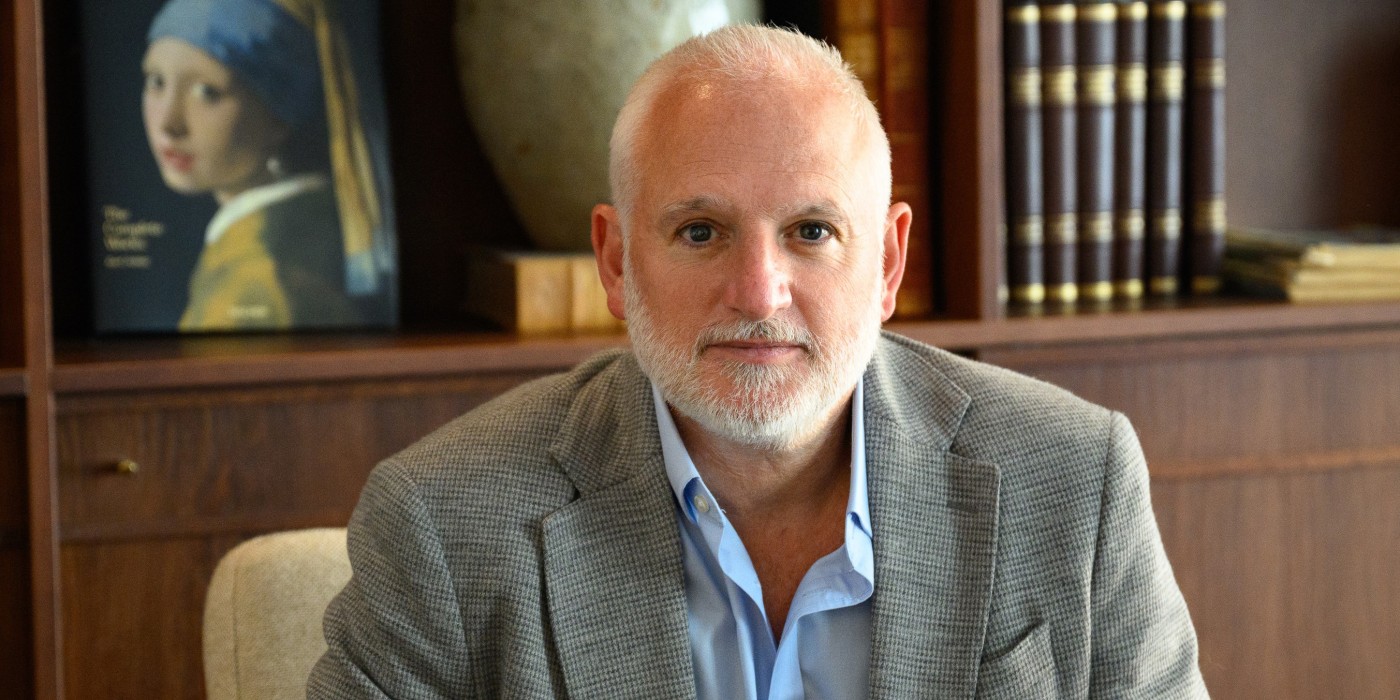

"It is with pride and joy that we today announce that we are taking the step into Denmark through the acquisition of 34 grocery and daily goods properties. That we, in these uncertain times, can enter a new market shows the strength in Cibus' business model. We strengthen our position as a market leader in the Nordics in grocery and daily goods properties and are the only operator acting in all four of the Nordic markets", says Sverker Källgården, CEO of Cibus.

The Transaction in brief

- The property value of the Transaction amounts to approximately DKK 2,080 million approximately EUR 280 million).

- The transaction agreement is estimated to be entered into prior to the commencement of trading on Nasdaq Stockholm on 25 March 2022.

- The Transaction is Cibus' first acquisition in Denmark and is in line with the Company's communicated strategy to increase its property holdings in the Nordics.

- Financing of the Transaction consists of a combination of external financing, funds from available cash and a directed share issue intended to be carried out by way of an accelerated bookbuilding procedure, which will be announced through a separate press release in connection herewith.

All Nordics

All Nordics

Sweden

Sweden

Denmark

Denmark

Finland

Finland

Norway

Norway