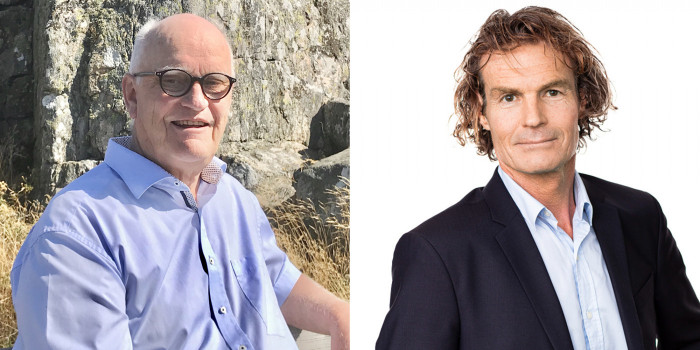

Like a bolt from the blue, Akelius stepped in in October and bought 12.2 percent of the shares in Castellum from Rutger Arnhult's company M2 Asset Management. With that, you became the largest owner in the company, and Roger Akelius looked favorably on the company.

"Castellum is a long-term investment. I am impressed by the management and board," Roger Akelius told Nordic Property News at the time.

Just under a month later, dark clouds have appeared in the Castellum sky for Roger Akelius. This after he read a quote from Rutger Arnhult about the company's financing situation.

"As you know, Akelius bought a 10 percent stake in Castellum recently and then I saw how the CEO went out and said that they have reassuring financing. To deceive all shareholders by saying that they have reliable financing – such a terrible scam. They don't have any reassuring funding at all. Castellum has some bonds that they cannot extend in a few years, and so they have to go out and sell real estate to get some money. But it is not possible to sell properties now," says Roger Akelius in an interview with GP.

According to Roger Akelius, the situation will worsen and he is worried about Castellum's rating. He now believes that the company must cancel new dividends to avoid bankruptcy.

"Rising for 24 years, but now I say you have to choose – bankruptcy or keep the dividends," says Roger Akelius to GP.

When asked if Roger Akelius has confidence in Rutger Arnhult, he says:

"I had it until he said that Castellum has reliable financing."

All Nordics

All Nordics

Sweden

Sweden

Denmark

Denmark

Finland

Finland

Norway

Norway